Rose Street Advisors Community | Life Happens

At what age should I buy permanent life insurance?

Like most things in life, there is always more to the story (not less) and permanent life insurance is a valuable tool when used in certain situations to achieve specific objectives. Recently, clients are asking the following question and it is deserving of a thoughtful answer: If I am someone considering buying permanent life insurance, at what age should I do that?

Brief sidebar: permanent life insurance refers to both whole and universal life insurance products where the coverage is intended to pay the life insurance proceeds to the policy beneficiary when the insured passes at some unknown time in the future. Most, but not all, build cash-values and offer policy owners various choices on how the premium dollars are invested inside the policy.

Factors to consider when discussing if permanent life insurance if right for you:

• You bought term life insurance, it’s expiring and you still need the coverage. What if your current health or

avocation status precludes you from buying new term insurance? In this situation, you may have the opportunity to

exercise a term policy’s “conversion rights” and “convert” to a permanent life insurance policy without the need to

provide any new medical evidence of insurability.

• You want flexibility or need to control how long the insurance coverage lasts.

• You need long-term liquidity due to the nature of your illiquid assets (i.e. the family cottage, farmland, commercial

real estate, business interests and partnerships, etc.) Dividing hard assets fairly among children without offsetting

cash is nearly impossible. Also, selling an asset under duress (a.k.a. “fire sale”) to create that cash prevents your

heirs from receiving full value for your hard-earned assets.

• You have a desire to pass wealth to the next generation; could health (long term care costs) and/or taxation

(income taxation on the passing of qualified money, federal estate tax liability, etc.) severely deplete or degrade the

value of your estate?

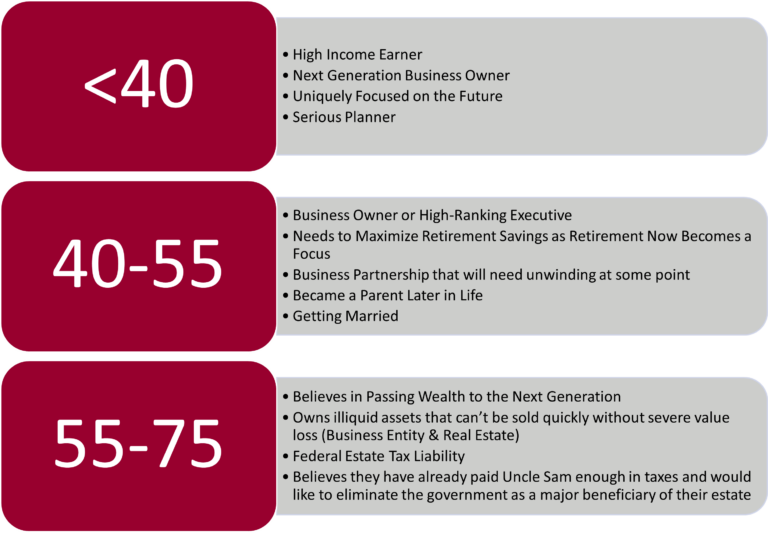

As for age, in a general sense, these are characteristics of a permanent life insurance buyer:

At Rose Street Advisors, our focus is to help clients understand what options best help them achieve their specific financial, business and estate planning objectives. Our team is ready, willing and honored to help. Please Contact Us by web or call 269.552.3200.

Rob Hunt II

Principal & CEO

As Principal and CEO, Rob spearheads the vision, drive for growth, and pursuit of excellence at Rose Street Advisors. Rob loves being outdoors with his wife Erin and kids. He has slalom skied for the past 35 years, never missing a season. He also enjoys spending time at the lake and on the golf course.

This material and the opinions voiced are for general information only and are not intended to provide specific advice or recommendations for any individual or entity. To determine what is appropriate for you, please contact your Rose Street Financial Professional. Information obtained from third-party sources are believed to be reliable but not guaranteed.

Securities and Investment Advisory: Services offered through M Holdings Securities, Inc., A Registered Broker/Dealer and Investment Advisor, member FINRA/SIPC. Rose Street Advisors is independently owned and operated. Rose Street Advisors is a member firm of M Financial Group. #5441330.1

Interested in more?

Securities and Investment Advisory Services Offered Through M Holdings Securities, Inc. A Registered Broker/Dealer and Investment Advisor, Member FINRA/SIPC. Rose Street Advisors is independently owned and operated.

Please go to www.mfin.com/DisclosureStatement for further details regarding this relationship.

Check the background of this Firm and/or investment professional on FINRA’s BrokerCheck.

For important information related to M Securities, refer to the M Securities’ Client Relationship Summary (Form CRS) by navigating to mfin.com/m-securities

Registered Representatives are registered to conduct securities business and licensed to conduct insurance business in limited states. Response to, or contact with, residents of other states will only be made upon compliance with applicable licensing and registration requirements. The information in this website is for U.S. residents only and does not constitute an offer to sell, or a solicitation of an offer to purchase brokerage services to persons outside of the United States.

This site is for information purposes and should not be construed as legal or tax advice and is not intended to replace the advice of a qualified attorney, financial or tax advisor or plan provider. CA Insurance License. File #5757992.1