Understanding Full-Time Equivalents (FTEs) Under the Affordable Care Act (ACA): A Guide for Employers

What is a Full-Time Equivalent (FTE)?

A Full-Time Equivalent (FTE) is a unit of measurement that represents the workload of an employee in a way that makes workloads comparable across various employment structures.

Who Needs to Calculate FTEs?

Employers across various industries use FTE calculations for multiple purposes. The purpose focus here today is companies subject to the Affordable Care Act (ACA): To determine if they qualify as an applicable large employer (ALE), requiring them to offer health insurance to full-time employees.

FTEs and the Affordable Care Act (ACA)

Under the ACA, employers must determine if they qualify as an Applicable Large Employer (ALE). This includes assessing common ownership across multiple employers. An ALE is an employer with an average of 50 or more FTEs in the previous calendar year. ALEs are required to offer affordable health coverage to full-time employees or face potential penalties.

How Does the ACA Define Full-Time and FTE Employees?

• Full-time employee: Works at least 30 hours per week or 130 hours per month.

• Part-time employee: Their hours are combined to determine the number of FTEs.

How to Calculate FTEs for ACA Compliance

To calculate FTEs for ACA compliance, follow these steps:

Step 1. Define Full-Time Hours: The ACA defines full-time employees as those working at least 30 hours per week or 130 hours per month.

Step 2. Identify Employee Hours Worked: Collect the total number of hours worked by all employees, including full-time, part-time, and seasonal employees.

Step 3. Apply the ACA FTE formula: FTE is calculated as FTE= Total Hours worked by part time employes divided by 30; plus total number of full time employees.

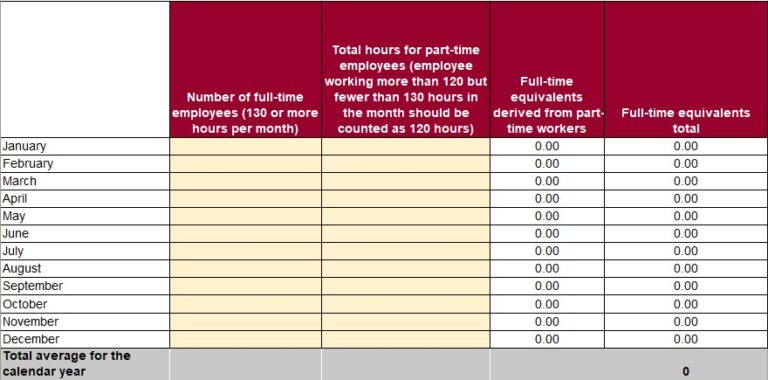

FTE Calculation Template

Final Thoughts

Calculating FTEs is crucial for determining ALE status under the ACA. If your company has 50 or more FTEs, you must comply with ACA employer mandate rules to provide health insurance coverage. Keeping accurate FTE records ensures compliance and helps avoid penalties.

Would you like help setting up an FTE calculator for ACA compliance? Contact your Rose Street Advisors Team today! If you are not a current client of Rose Street Advisors, please feel free to contact us at 269-552-3200 or contact@rosestreetadvisors.com to speak to someone.

Justine Dickens

EMPLOYEE BENEFITS ADVISOR

Justine is a devoted and meticulous team member with a passion to educate and support business partners and their employees. Since 2013, Justine’s commitment to her clients has allowed her to instill confidence and stability in the benefits packages offered to their employees. Her strengths allow her to communicate efficiently, focus on customization and understand the complexities of an ever changing industry. She is a Dale Carnegie Graduate and has her NAHU Self-Funded Certification.

When she is not working, Justine is busy running her son and daughter to their practices and games and volunteering in the community. She enjoys playing golf, hiking and spending time with her family and friends.