Financial wellness has become a defining issue for today’s workforce. In 2026, employees are navigating ongoing financial pressure from rising living costs to increased complexity around benefits and retirement decisions. As a result, financial stress is no longer confined to employees’ personal lives; it shows up in the workplace and […]

Read More

Many participants focus on how to save, but few think about how to withdraw. A thoughtful income strategy in retirement may reduce taxes, provide more flexibility, and increase the longevity of your nest egg. Here are three simple guidelines to keep in mind: 1. Diversify your withdrawal sources Use a […]

Read More

As a business owner or CFO, you know how important it is to attract and retain top talent. One powerful, but often overlooked, tool for rewarding key employees is a cash balance plan, especially when implemented retroactively for the prior year. What Is a Cash Balance Plan? A cash balance […]

Read More

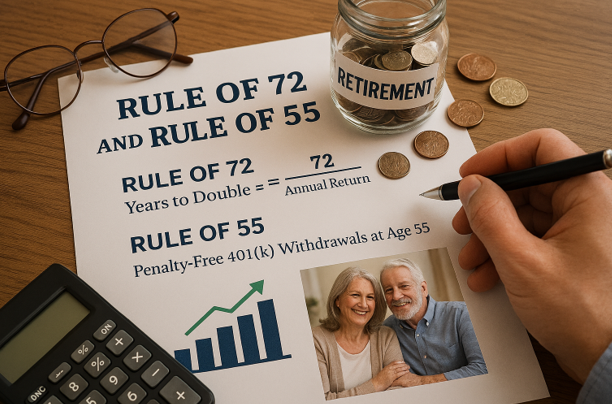

Two Simple Tools for Smarter Retirement Planning When it comes to planning for retirement, a few simple rules can make complex concepts easier to understand. Two of the most helpful are the Rule of 72 and the Rule of 55. Both can give you quick insight into how your savings […]

Read More

When organizations begin exploring a merger or acquisition, most of the attention naturally goes to valuation, legal structure, synergies, and integration timelines. Yet one critical element often sits just beneath the surface; the retirement plan. For business owners, CFOs, and HR directors, overlooking how retirement plans will be handled during […]

Read More

How Inflation Can Affect Retirement Savings and Ways to Mitigate Its Impact Planning for retirement is challenging enough, but one factor often underestimated is inflation, the gradual increase in prices over time. Even modest inflation can erode the purchasing power of your savings, meaning the money you’ve set aside may […]

Read More

As you near retirement, your focus often shifts from building wealth to protecting it and to making sure the people and causes you care about are provided for. Estate planning plays a key role in that transition. It’s not just about legal documents; it’s about financial confidence. An effective […]

Read More

Retirement Planning for Small Business Owners: A Smart Approach to Business and Personal Wealth As a small business owner, you’re often focused on running and growing your company such as managing employees, balancing cash flow, and planning for the next big opportunity. But one area that can easily slip down […]

Read More

Roth Catch-Up Contributions – Are You Ready for January 1, 2026? Starting January 1, 2026, a key provision of SECURE 2.0 will officially take effect: Roth Catch-Up Contributions will be mandatory for certain high-income earners aged 50 and older. This change, originally slated for 2024, was delayed giving plan sponsors, […]

Read More

Top 5 Things to Consider in Retirement For many people, retirement feels like the finish line but in reality, it’s the start of a whole new chapter. Whether you’re just a few years away or already in your first years of retirement, the decisions you make now can shape your […]

Read More